Trading signal and it's outcome - Spotting 10 trades challenge

Topic: "Identifying market reversal in US stock indices" on 8th January 2020. We are thankful to have this opportunity to design this topic on behalf of CME Group. The partnering organizer has given us a "10 trades challenge", this means to alert 10 potential trading opportunities to their guests who have attended the presentation.

Out of the "10 trade challenge" sent, to date, 7 trades have it's objective met, 2 trades are still in it's developing stage and 1 trade has been stop-out. Among all, the most satisfying trade was on trading signal 6 on Crude Oil with a $7 gain or 12% depreciated in it's prices over 5 trading days. To demonstrate the application taught can also be applied to other markets (gold, crude, US indices, soft commodities and bonds), following is an archive on the studies of the potential trading opportunity sent and it's subsequent outcome. This studies is to facilitate learning on identifying hammer and inversed hammer with higher weighting, and it is not a trade recommendation. Please see disclaimer before to continue.

For you to acquire this understanding on it's application. I have include a teaching video at the end of this page.

Our Forecast

The Result

Micro E-mini Dow Jones D 09 Jan 20 Main trend: Uptrend Entry strategy: Buy or buy on any dip Managing strategy: "Buy 2, Sell 1" & stop loss on any daily closing below 08 Jan's low Time frame: 2 days to 3 months

CME Comex Gold Day Chart 09 Jan 20 Main trend: Uptrend Entry strategy: Sell or sell on strength Managing strategy: Since to sell, it is against the main trend, therefore "Sell 2, Buy 2" instead, & stop loss on any daily closing above 08 Jan's high Time frame: The next few days

CME CBOT Corn Day Chart 13 Jan 20 Main trend: Range to up Entry strategy: Buy or buy on any dip Managing strategy: "Buy 2, Sell 1" & stop loss on any daily closing below 09 Jan's low Time frame: 2 days to 3 months

CME Micro E-mini SnP Day 15min chart 14 Main trend: Uptrend Entry strategy: Buy or buy on dip Managing strategy: "Buy 2, Sell 1" Time frame: Intra-day to a few days

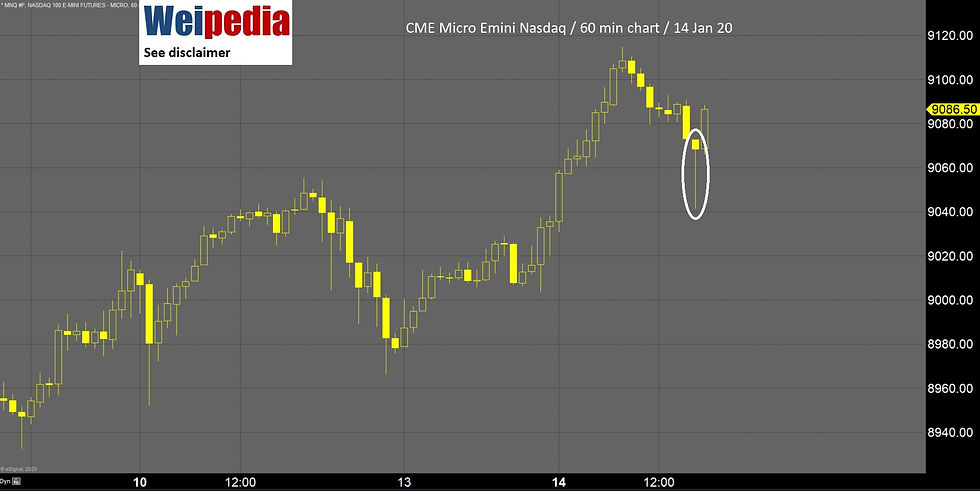

CME Micro E-mini Nasdaq 60 min chart 14 Main trend: Uptrend Entry strategy: Buy or buy on any dip Managing strategy: "Buy 2, Sell 1" & stop loss on any daily closing below 4pm low Time frame: Intra-day to a few days

CME NYMEX Crude Oil 60 min chart 20 Jan Main trend: Range Entry strategy: Sell or sell on strength Managing strategy: "Sell 2, Buy 2" & stop loss on the 60 min closing above this morning highest point Time frame: 2 days to the next few days