By Wong Kon How

An interest rate cut isn’t the key reason for recent USD weakness

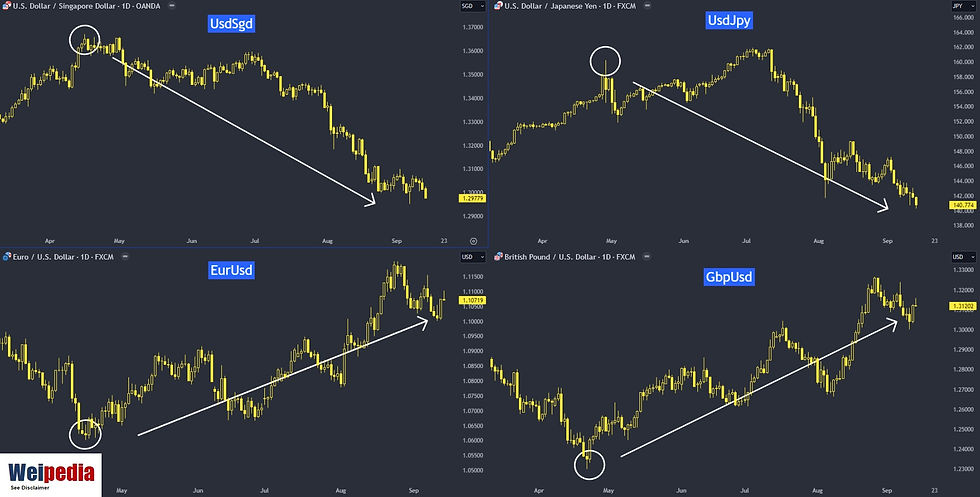

The US dollar has been sliding since around April, weakening against the SGD and JPY, while the EUR and GBP have strengthened against the USD.

Besides the Fed potentially cutting interest rates soon, what are the other key reasons behind the weak performance of the US dollar? What about its long-term trend? Will it continue to weaken, or is a rebound into strength expected?

We will use these key factors to also analyze the long-term direction of the US dollar.

Source: Tradingview

Has the USD always been that strong?

That depends on which currency you're comparing it to. Over the past decade, the USD has depreciated by 44% against the SGD and by a staggering 71% against the CHF. One might ask why this is so. While the USD remains strong compared to currencies in emerging markets, it has underperformed against the SGD and CHF. The main reason for this is debt. Debt created by printing money dilutes the currency, weakening it over time.

At the end of 2023, Switzerland's net federal debt stood at CHF 142 billion, while U.S. federal debt currently stands at USD 34.832 trillion. In relation to their respective GDPs, the U.S. has a debt level many times higher than Switzerland’s. This is reflected in the USD/CHF exchange rate, where the Swiss franc has appreciated against the U.S. dollar since 1985.

Source: Tradingview

A better benchmark to monitor USD – The Dollar Index

The Dollar Index measures the value of the U.S. dollar relative to a basket of six major world currencies: the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc. It serves as a benchmark for the dollar's global strength. However, it has been facing resistance in 2022. If we examine key points from 1985, 2001, and 2002, and project forward, 2022 marks another significant turning point, suggesting that the Dollar Index—and therefore the USD—is on a downward trajectory.

Source: Tradingview

Market Outlook:

As long as U.S. debt continues to rise each year, the risk of a declining dollar remains high. Pay close attention to U.S. economic growth, stock market performance, bond prices, and debt levels, as these factors are closely linked to the value of the USD. Based on these analyses, my strategy is to sell into USD strength when opportunities present themselves.

This article was first submitted to CMC Markets on 16th September 2024 for publication. Here's the link.

Comments